Global Market Of Luxury Properties Led By Canadian Cities

According to a new white paper report by Christie’s international Real Estate and Canadian affiliate Chestnut Park Real Estate of Toronto, Toronto and Victoria BC are at the top of the list of hottest luxury residential real estate markets in the world.

This report produced per annum analyzes how macroeconomic factors influence home prices, inventory and sales all over across more than 100 real estate markets affiliated to Christie’s real estate and worldwide.

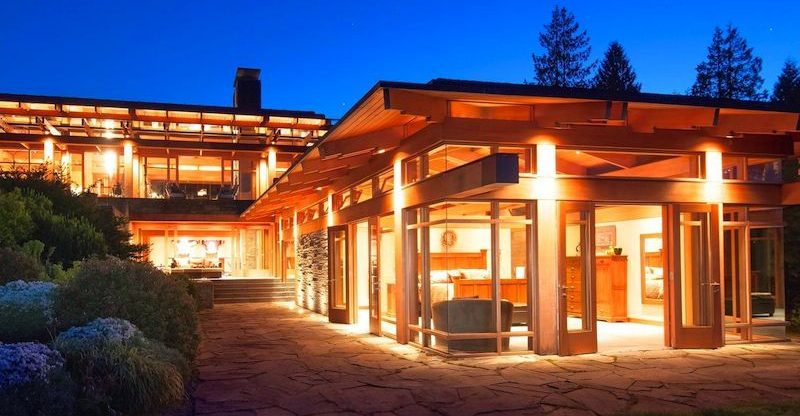

The average worldwide starting point for luxury real estate is $2.1 million (US). For Toronto, we talk about luxury real estate for properties worth $3 million (US) and above. This market is fed mostly by foreigners, more especially Chinese buyers. Even though the international luxury real estate market has experienced decrepitude, Toronto and Victoria markets have not been biased. This decrepitude or decline in some traditionally strong luxury markets is caused by global uncertainty.

United Kingdom luxury real estate market’s growth has declined by 67 per cent, that of Asia Pacific by 29 per cent and the United States’ by 4 per cent. Europe’ luxury real estate market increased by 20 per cent and Canada’ market experienced a tremendous growth of 44 per cent.

Worldwide, luxury homes fool around 221 days on the market, up from 195 days in 2015 but the Toronto market stood at 17 days on market (down from 28 days in 2015) and the lowest in the world inflamed by extremely low inventory and active price increase which encourages buyers to act fast.

The new Vancouver’s 15 per cent foreign buyer’s tax acted like a wet blanket on international buyers who invested in the Victoria BC market which then experienced a significant growth. Capital inflows did not decrease but shifted demographically as Chinese buyers entered new markets like that of Montreal, new enclaves in Toronto and areas outside of Canada like New Carolina.

As Canada’s luxury second home market rose by 36 per cent in 2016, US’ market dropped by 3 per cent. This fact is a reflection of the prevailing sense of skepticism among buyers, especially foreign buyers.