Crypto Custody: An Obstacle To Institutional Investment

It is the opinion of several finance professionals that a lack of cryptocurrency services being offered by institutional custodians are a significant barrier to widespread institutional investment in the virtual currency sector.

In an interview with Pensions & Investments, Blake Estes of Alston & Bird LLP stated: “For chief investment officers, there’s only downside risk in cryptocurrency.” They added that it “would take a leap of faith with a new custodian with no brand recognition. That presents a real risk for them.”

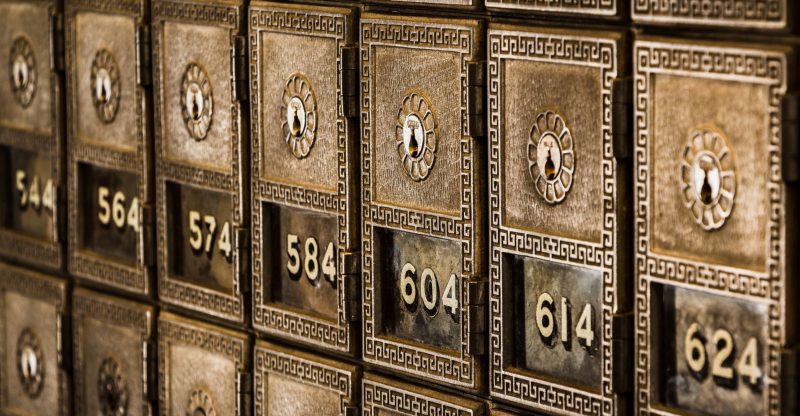

Mr. Estes of Alston & Bird shares this opinion, and he stated that “So much of the security of bitcoin and other cryptocurrency rests with who stores that private key, who controls the vault. Blockchain (the technology behind the transfer of assets) itself can’t be hacked, but it all still boils down to who ends up holding the keys. I’d tend to think that pension funds will not venture into uncharted territory until they’re certain about the security of who has custody of the keys.”

The vice president of Callan LLC, Mark Kinoshita, thinks that the virtual currency industry has a long way to go to witness institutional custodians offering services to cryptocurrency investors.

Mr. Kinoshita said: “I don’t know that (custodians) are focused on cryptocurrency; I think they’re more focused on blockchain and distributed ledger technology and their use in operations. They’re joining consortiums that are looking at uses in things like cross-border services, clearing, and settlements. Rather than comment on crypto custody, they’re working with partners in fintech and insurance firms to determine applications of blockchain and (distributed ledger technology) to streamline clearing and settlement processes. They’re still at the exploration stage.”

John Lore agrees to the fact that the cryptocurrency sector is still to develop itself for institutional custodians. He stated that “it’s really too soon to determine what cybersecurity risks will need to be dealt with, there aren’t enough custodians who are capable of handling that risk yet. […] If you want a long-term storage of assets in a digital wallet, there are regulatory ways of doing that, but none that are recognized across the large custodians, Once there, it’s an asset that’s very easy to lose, through computer failure or hacking. At the core, that’s a major risk issue.” John is managing partner, Capital Fund law Group PC, New York.

The founder and CEO of IronChain Capital, Jonathan Benassaya, believes the lack of institutional custodianship in the cryptocurrency sector is due to the “vicious cycle” in which “investors want the infrastructure from custodians,” however, “custodians want investors before they build the infrastructure.”

Even at that, Mr. Benassaya still expects that custodians “are not so far” from being part of the cryptocurrency industry. He states, “You read about crypto custody because of general news about data hacking and security. They want it safely stored in a vault, like gold. […] The level of custody in crypto is the same as with other assets, except that crypto is self-cleared through the blockchain. Custodians are not so far away from making this happen.”