Housing Market To The Rescue!

From bad to worse!

With Canada’s economy trying to bounce back from the oil crash, economists believe that the only way the economy could be rescued is through the housing market.

“Our bigger concern now is that the housing bubble will burst before the year is out,” economists Paul Ashworth and David Madani wrote.

The country’s economy has been affected by a collapse in business investment simply due to the oil market crash.

Capital Economics, as well as other forecast agencies, have detected this investment slump coming to an end. Analysts have predicted that the bubble would burst sometime around the second half of this year. However, given the pace at which business investments are picking up, the country is likely to be walloped by a slide in house prices, the London, U.K.-based economic consultancy predicts.

The prices of houses have not increased so much by foreign investors. Instead, low-interest rates have severely affected the amount of mortgage debt to “ridiculous levels,” the economists wrote.

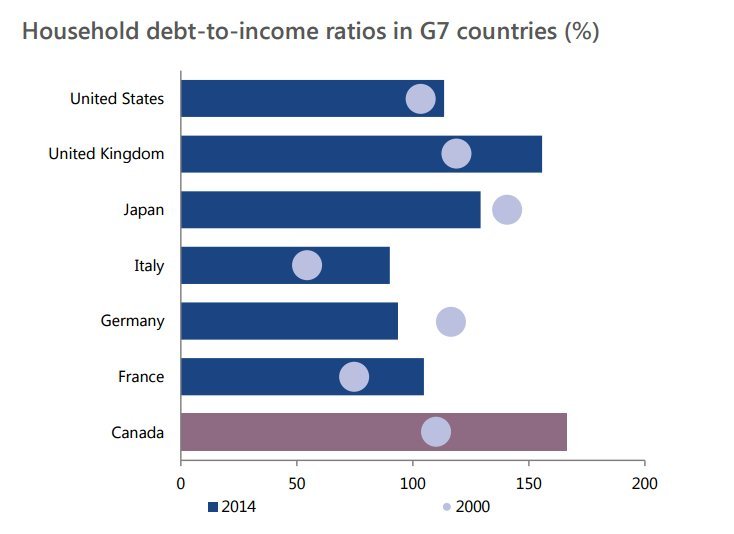

On household debt, Canada has gone from being middle of the pack to leading the G7. (Chart: PBO)

If there were to be a downturn in the housing market, it would definitely affect the country’s economy more than downtown oil prices. The reason is quite obvious- the real estate market has attracted more investors compared to the oil industry.

Statistics indicate that real estate and construction accounts for up to 20% of Canada’s economy today. Oil and gas extraction, on the other hand, accounts for 6% only.

“When the bubble bursts, residential investment will fall sharply, as falling home sales hit real estate commissions and new construction,” Capital Economics wrote.