Toronto real estate results to the highest national index in February

Toronto’s affordability problem is sparking more problem than anticipated as the real estate market is leading to an abnormal increase in national prices. In February, Toronto, Hamilton and Vancouver home prices drove the national index to a record high for the month of February.

According to a recent release from Teranet-National Bank, Toronto took the lead with a 1.9% increase in February home prices which is just a indication that the city is headed for another hot year.

The national index soared 1.0%, a gain which is the largest February increase ever recorded by the Teranet-National Bank National Composite House Price Index.

Hamilton and Vancouver also had an increase of 1.4% while in Ottawa-Gatineau, there was a 0.9% rise. However, home prices plummeted in seven other Canadian real estate markets.

The rising home price in Toronto is however becoming a worrisome situation says Marc Pinsonneault, National Bank senior economist in a release.

Currently in Toronto, most of the home sales are on apartments which make up 26% of all sale transaction while the sale of other home types has become a major problem thanks to their high price tags.

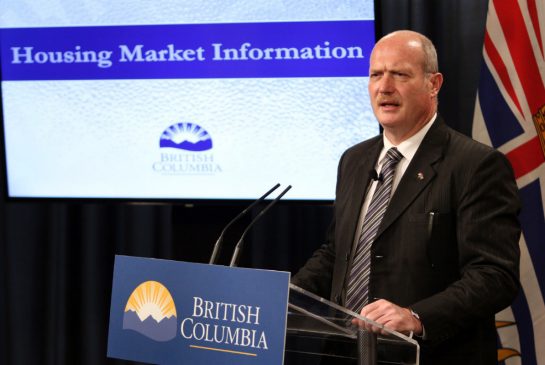

This uncontrolled situation has led Ontario’s Finance Minister Charles Sousa to ponder on the idea of implementing a similar foreign buyers’ tax like Vancouver to help address the affordability problem.

The Toronto Real Estate Board’s figures show that the Greater Toronto Area average home price has exceeded $1.5 million while the average home prices for detached homes in nearby areas have gone above $1 million.

It has now become evident that the Canadian real estate market is headed in contrasting directions. While homes prices continue to remain high in markets like Toronto, Hamilton and Victoria, other markets are recording moderate or low home prices.

In February, home prices in Halifax, Calgary and Montreal dropped by 1.9%, 1.3% and 0.2% respectively.