More hiring to happen in the country according to a recent survey

The survey conducted by the Bank of Canada has shown that businesses in Canada are expected to expand their workforce and make investments over the coming 12 months.

51% of the businesses surveyed expectations of expanding their workforce over the course of the coming 12 months in comparison to the 15% of the entire survey who favored a smaller workforce.

The number of businesses looking to hire more is higher than it has even been since 2014 at a time when oil prices sped slowly downwards.

However the surveyed businesses are hopeful that the energy-related activities will take off; improve and the “favorable effects of the weaker Canadian dollar for exports and the tourism sector” along with higher commodity prices being responsible for the increase of costs.

“Meanwhile, some firms believe that activity in sectors experiencing robust growth (such as housing and automobiles) could soon level off,” said the report. A few also cited regulatory factors, such as cap-and-trade policies in Ontario and the carbon tax in Alberta, as contributing to their input price growth.”

It is interest to hear an increasing number of Canadians say that they are optimistic about the economic growth of its immediate neighbor to the south as it is led by the ever-controversial, Donald Trump. However, the uncertainty floating in the air over his agenda is quite risky.

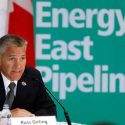

The controversial Keystone XL pipeline might be beneficial along with U.S. infrastructure spending.

“These risks include increased protectionism, reduced competitiveness of Canadian firms in the event of corporate tax cuts in the United States, and possible delays in the implementation of pro-growth U.S. policies,” said the report.

Interest rates to not budge

TD Economics senior economist, Brian DePratto, wrote that BoC is “undoubtedly pleased with today’s report…..not likely to change the dovish tone of recent communications”, while he added that, “it may be reasonable to expect solid economic momentum as we head into the remainder of 2017. ”

What is dovish?

Dove refers to an economic policy advisor who promotes monetary policies that involve low interest rates, based on the belief that low interest rates increase employment. It is the exact opposite of hawkish.

“Until intentions begin translating into actual investment, Bank of Canada officials appear likely to downplay today’s [business outlook survey] and the recent improvement in the Canadian economic data more broadly,” wrote DePratto.

BoC will make its next interest rate decision privy on 12th April.

All twelve of the economists surveyed by Bloomberg expect that the bank will keep interest rates plateau.