Efforts Made by Canada to Revolutionize Payment

From a technological point of view, it’s quite the norm that Canada is one of the leading and most sophisticated countries in the domain. So why should Canadians have to wait for days, weeks or even months for their cheques to be processed?

This is all due to the Canadians back-end payment infrastructures, which gets things done but it’s not in par with the modern technological advances of our present time.

Several small businesses here in Canada still do not accept online or electronic payments, which is rather unfortunate because they need to be conversant with it. This will help discard friction from payments and the Canadian economic performance.

In 2015, a consultation on future payments was conducted by Payment Canada. It received multiple responses by Canadian businesses, which suggested very key requirements. But of all those requirements, the most demanding was the need for more information accompanying payments.

Recommendations have been made already for modernizing the current payment system and one of those is the usage of a standard language to help carry about more information on payments. An international standard singled out by Payment Canada’s vision document is known as ISO 20022.

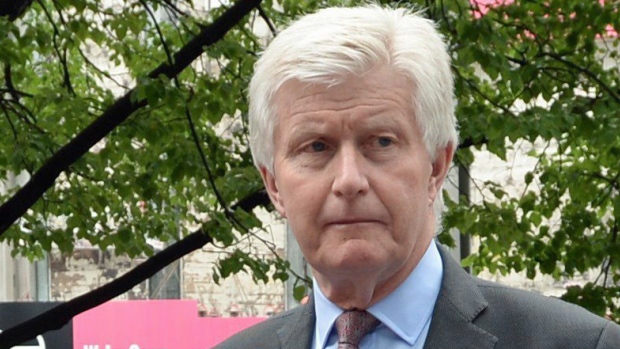

As soon as this new standard is incorporated into the software of Canadian businesses and their online services, it will simply take payment process for small businesses to a whole different level, says Robert Vokes. The managing director of financial services located at Accenture Canada.

There is still much work to be done for Canada’s payment system to reach world class. So the next big effort is the modernization of the Large Value Transfer System (LVTS), according to Vokes. This payment system will help settle large-value, cynical transactions like the down payment on a house. All managed by Payments Canada.

Thereon, more attention will be given on developing the capabilities of real-time payments and boosting transfer of automated funds, necessary for payroll.

According to Payment Canada’s roadmap, the Automated Clearing Settlement System needs to be rebooted. This system controls electronic payments and Canadian dollar cheques which must be in sync with Canadian banks, be it PayPal payments that gets into your account or ATM withdrawals.

With this put in place, all the banks in the country including the Bank of Canada will be largely impacted and it will facilitate the link between the large and small merchants and consumers alike.

Lastly, the rules surrounding payments must be completely revised. This will enable proper organization on how security and risk issues can be managed, so as to prevent future setbacks.