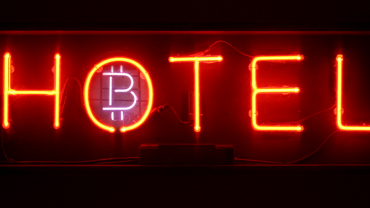

Study Shows That Hard Forks Constitute Threat To Cryptocurrency Stability

Another examination proposes that the dependability of digital currencies is threatened by software updates, known as “hard forks,” according to a September 12 official statement. The investigation expresses that clear rules on software updates could help balance out cryptocurrencies.

The paper was set up by a group of analysts, driven by the Oak Ridge Institute for Science and Education fellow Benjamin Trump, who checked on the condition of cryptocurrency “forks” by exploring more than 800 delicate forks and hard forks from Bitcoin (BTC).

While the examination says that digital currencies can possibly change business and data exchange on a worldwide scale inferable from the basic blockchain technology, Trump argues that administration challenges threaten the strength of crypto. “Disruption of a cryptocurrency’s blockchain in this way might cause people to lose trust in it and its capacity to survive as a reliable vehicle of exchange,” Trump proceeds.

The investigation allegedly found that a considerable amount of BTC forks and altcoins did not survive over a while, however, some of them have dug in themselves and went on for quite a long time. Per the analysts, hard forks will turn out to be more customary, with up to 50 possible in 2018 alone. Trump clarified:

“Hard forks are a threat to maintaining a stable and predictable operating platform that is essential if cryptocurrencies are to be adopted for daily financial transactions.”

Concerning the possible future of BTC as a perceived medium of exchange on a worldwide level, Trump argued that administrators inside the BTC system, for example, crypto miners, wallet developers, trades and others, should grow better administration to give security.

Another examination directed by Initial Coin Offering (ICO) advisory firm Satis Group toward the end of August, proposes that the BTC cost could reach $98,000 in the next five years. Per the report, the estimation of cryptoassets expected to help the economy will increase from around $500 billion one year from now to $3.6 trillion by 2028, while 90 percent of cryptoasset value will be separated from penetration of offshore deposits in the next decade.