Similar To Gold, Bitcoin Is Not An Ideal Medium Of Exchange: Says CFTC Chairman

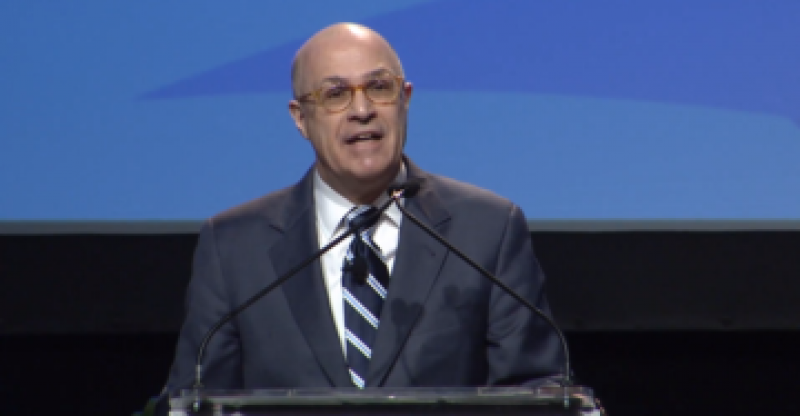

Chairman J. Christopher Giancarlo of Commodity Futures Trading Commission (CFTC) has noted that bitcoin has some similarities to that of gold, even though it has numerous different asset categories.

Giancarlo, who is generally referred to as “Cryptodad” by several cryptocurrency fans as a result of his acceptance to be part of the promising industry with an open mind, noted in an interview that bitcoin is not an ultimate medium of exchange but has similar characteristics to that of gold.

“There are certain aspects of this that you might call a virtual asset like gold, only it’s virtual, it’s digital,” he said. “But it is an asset that many find worthy of holding for a long time and that has aspects to it that might not be ideal as a medium of exchange that might be more suited as a buy and hold strategy.”

According to the markets regulator, it is not easy to categorize bitcoin and several cryptocurrencies into current regulatory categories.

“Bitcoin and a lot of its other virtual currency counterparts really have elements of all of the different asset classes, whether they’re meeting payment, whether it’s a long-term asset,” he said. “We see elements of commodities in [bitcoin] that are subject to our regulations, but depending on which regulatory regime you’re looking at, it has different aspects of all of that.”

Regulators and lawmakers have debated on whether they should grant the CFTC and the Securities and Exchange Commission (SEC) should have more power to supervise the cryptocurrency market, however, Giancarlo has highlighted that any such determinations must be made at the legislative level and not the regulatory.

Presently, the CFTC oversees the trading of bitcoin futures, which are categorized as commodities and are presently listed on US exchanges CBOE and CME.